Na mídia

Fonte: ITR

Tax advisers in Brazil are rising above the country's notoriously complex tax system to deliver high-quality advisory services, ITR's exclusive in-house data reveals

Brazilian tax advisers are delivering exceptional services thanks to their intimate knowledge of the country's complex tax system, ITR client survey data suggests.

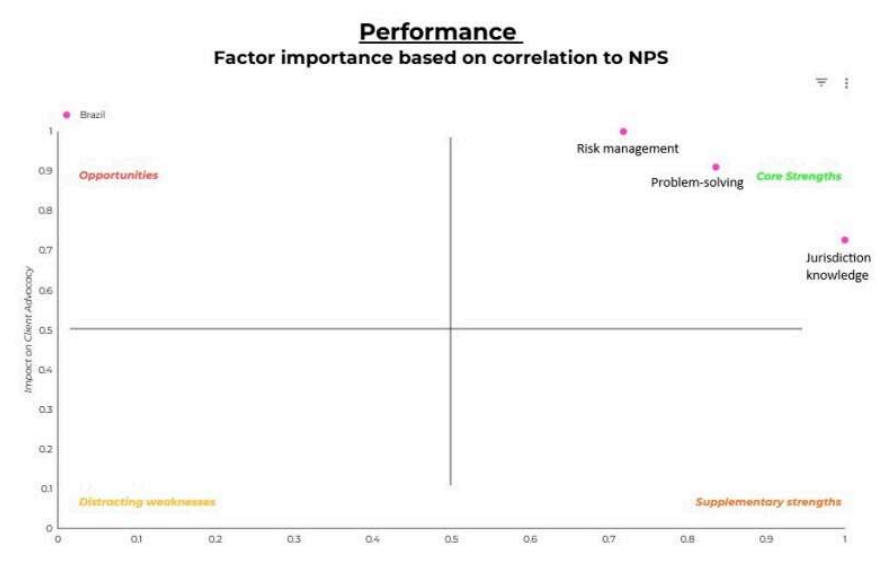

According to ITR's survey of thousands of corporate counsel, Brazilian tax advisers are rated highly across three key metrics: risk management, problem-solving, and jurisdictional knowledge.

Across aIl three factors, in-house respondents rated them as both high in importance and high in satisfaction. For example, problem-solving received a satisfaction score of 8.4 out of 10, and an importance rating of 9.1 out of 10.

The ratings meant that all three factors fell in the 'core strengths' quadrant, suggesting that Brazilian advisers are delivering high-quality services where it matters most to clients.

Survival of the fittest

After overhauling both its indirect tax and transfer pricing regimes in recent years, it's easy to see why Brazil is considered a complex tax jurisdiction.

"As we jokingly say in Brazil: 'Brazil is not for amateurs", says Daniel Cordeiro, global tax director at Brazilian aviation company Embraer.

"This is even more true in the tax landscape," he adds.

For Cordeiro, this complexity has led to Brazil producing best-in-class tax advisers.

"Given the inherent complexity of the Brazilian tax system, with multiple different layers of indirect taxes, withholding taxes, and miscellaneous taxes, to be an adviser in Brazil, you must be on top of your game 100% of the time."

Allan Fallet, a tax partner at law firm Duarte Garcia, Serra Netto e Terra in Säo Paulo, agrees that Brazil is generally considered to have "the most complex and fragmented tax system in the world".

He cites data from the World Bank, which shows that a mid-sized company in Brazil spends more than 2,600 hours annually complying with tax obligations, more than eight times the OECD average.

And on the subject of indirect tax reforms, Fallet argues that Brazil's shift to a destination-based VAT system, combined with the growing digitalisation of tax audits, is "reshaping the entire ecosystem".

He says: "This level of complexity necessitates a very high standard of legal and technical expertise.

"Tax professionals in Brazil are expected not only to master intricate legislation and case law but also to develop highly analytical and strategic skills to navigate ongoing reforms, multilevel litigation risks, and a fast-moving regulatory framework."

On the problem-solving factor specifically, Cordeiro says this skill is a "must" if advisers want to provide clients with "actual value-adding advice".

He adds: "This high level of complexity has turned the tax advisory market in Brazil into a 'natural selection' environment where only the fittest can survive.

"Thus, once clients are evaluating their advisers, there is this natural tendency that they will have great advisers. "

Fallet backs this up: "It is not surprising that in-house tax leaders recognise Brazilian advisers as among the most capable globally.

"They are trained to operate in an exceptionally complex jurisdiction, equipped to deliver sophisticated and pragmatic solutions, and increasingly empowered by cutting-edge technology."